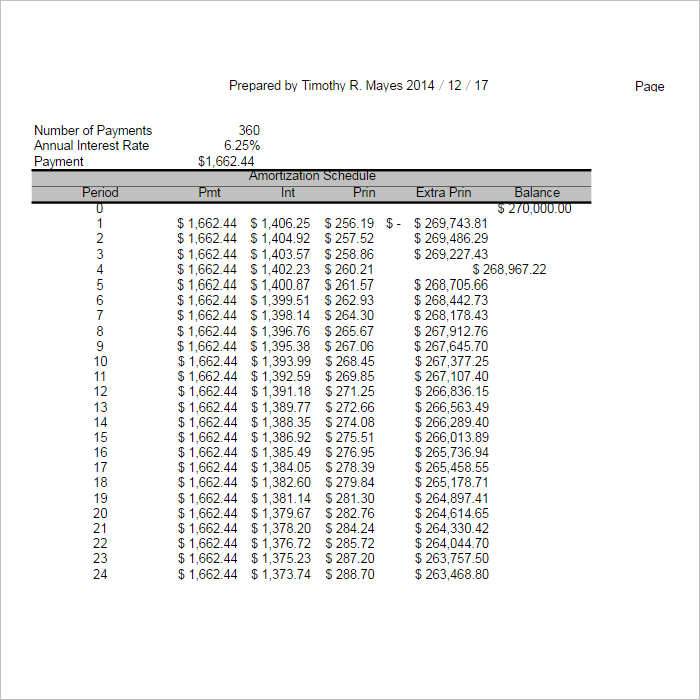

Amortization is the process of separating the principal and interest in the loan payments over the life of a loan. After she has made her final payment, she no longer owes anything, and the loan is fully repaid, or amortized. The amount borrowed that is still due is often called the principal. In these timed payments, part of what she pays is interest. When she makes periodic loan payments that pay back the principal and interest over time with payments of equal amounts, these are considered fully amortized notes. When a consumer borrows money, she can expect to not only repay the amount borrowed, but also to pay interest on the amount borrowed. While they have some structural differences, they are similar in the creation of their amortization documentation. The quicker you assess a person's ethical tendency, the awareness empowers you to develop a strategy on how to interact with them.In our discussion of long-term debt amortization, we will examine both notes payable and bonds. It is essential that leaders, managers, and employees are able to distinguish between positive and negative ethical behavior. This quiz is designed to assess your current ability for determining the characteristics of ethical behavior. This Quiz is compiled of questions that pertain to IPOs (Initial Public Offerings)

Understanding this information will provide fundamental knowledge related to marketing research.

The following quiz will assess your ability to identify steps in the marketing research process.

This quiz gives students the opportunity to assess their knowledge of cost concepts used in managerial accounting such as opportunity costs, marginal costs, relevant costs and the benefits and relationships that derive from them. Academic Reading and Writing: Critical ThinkingĬost Concepts: Analyzing Costs in Managerial Accounting

0 kommentar(er)

0 kommentar(er)